China’s Xu Hongjie (r) and India’s Anil Kakodkar chat after dinner at the Thorium Energy Conference in Geneva this week. Xu leads China’s TMSR programme. Kakodkar, former chairman of India’s Atomic Energy Commission and one-time head of the country’s Bhabha Atomic Research Centre, champions thorium use in his country.

GENEVA – Thorium-fueled high temperature reactors could help alleviate China’s energy and environmental problems – including water shortages – by providing not only low carbon electricity but also clean heat for industrial processes and power for hydrogen production, the scientist in charge of developing the reactors said here.

Xu Hongjie of the Chinese Academy of Sciences (CAS) in Shanghai indicated that one of the two reactors he’s developing should be ready in a 100-megawatt demonstrator version by 2024, and for full deployment by 2035. A second one, based on liquid thorium fuel instead of solid, would come later, he said, hinting that it might not yet have full government financial backing.

In a presentation at the Thorium Energy Conference 2013 (ThEC13) here, he referred to both reactors as thorium molten salt reactors (TMSR). The solid fuel version uses “pebble bed” fuel – much different from today’s fuel rods – and molten salt coolant. The liquid version uses a thorium fuel mixed with molten salt. Both run at significantly higher temperatures than conventional reactors, making them suitable as industrial heat sources in industries such as cement, steel, and oil and chemicals. The thorium can also reduce the waste and the weapons proliferation threat compared to conventional reactors.

“The TMSR gets support from the Chinese government, just because China is faced with a very serious challenge, not only for energy, but also for the environment,” Xu said. He noted that several regions of China face water shortages in large part because China’s many coal-fired power plants require water for for cooling, as do China’s 17 conventional nuclear reactors.

“Water scarcity is very serious for China,” he said. “Most of the water has been consumed by electricity companies – for coal but also nuclear.”

GIGAWATTS AND GIGAWATTS

Nuclear reactors will help slow the growth of China’s CO2 emissions. The country today gets about 80 percent of its electricity from CO2-spewing fossil fuels. As China ramps up generating capacity to an estimated 3,000 gigawatts by 2030 – more than double today’s level – it will need to find low-carbon sources to mitigate climate change consequences.

Xu is the director of CAS’ of Thorium Molten Salt Reactor (TMSR), based at the Shanghai Institute of Applied Physics, overseeing what he said is a $400 million project (China has described it in the past as $350 million). He calls the solid fuel reactor a “TMSR-SF,” and the liquid reactor a “TMSR-LF”.

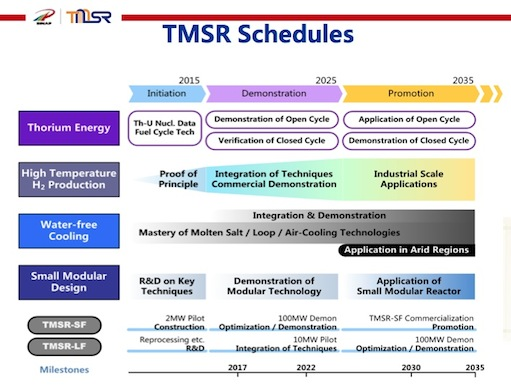

One of two timelines (see below) that Xu included in his presentation showed that he expects to complete a 2-megawatt pilot for the solid fuel version by around 2015, and a 100-MW demonstrator model of the same by 2024, before readying it for live use in 2035 in “small modular” form (general industry nomenclature would call the solid fuel version an “FHR”, or fluoride salt-cooled high temperature reactor).

That timeline did not show a target date for a 2-MW liquid-fueled pilot reactor, which a year ago appeared to have slipped from 2017 to 2020. It did, however, show a 10-MW liquid-fueled pilot at around 2024, and a demonstrator version by 2035. It did not include a commercialization date. “For liquid, we still need the financial support from the government,” Xu said .

Solidifying the future. The solid fuel (TMSR-SF) molten salt cooled thorium reactor will be ready before the liquid fuel model (LF).

Xu explained that the liquid version requires more complicated development than the solid version, such as “reprocessing of highly radioactive fuel salts.” But the reprocessing, when worked out, will become an advantage because it will allow re-use of spent fuel, whereas the “open” fuel cycle of the solid version will not, he noted. Xu said that the solid fuel version is a “precursor” to the liquid-fuel reactor.

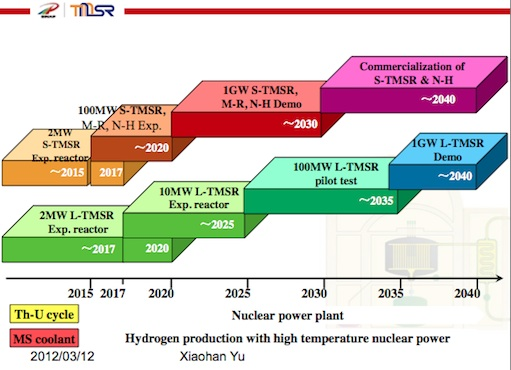

A second timeline showed plans for developing larger TMSRs, with a 1-gigawatt capacity. It showed “commercialization” for the solid fuel version by around 2040, when the liquid 1-GW machine would reach a “demonstrator” state. The timeline does not show commercialization plans for the 1-GW liquid version. It does, however, show that a 2-MW “experimental” liquid TMSR could by ready by around 2017 .

This slide, part of Xu Hongjie’s presentation, shows the timeline for a large TMSR, and suggests it would be used for hydrogen production.

After his presentation, I asked Xu to clarify the difference between the two timelines and the state of government financing, but he declined.The second timeline shows the 1-GW reactors going to work for hydrogen production, a process that China mentioned at last year’s conference, held in Shanghai. Xu reiterated that China would combine hydrogen with carbon dioxide to form methanol, a clean energy source.

MULTIPLE USES

China has also talked about using TMSRs for coal gasification, and to convert coal to olefin and coal to diesel.

Xu told me the TMSRs would be used for electricity generation as well, although one slide in his presentation notes that the aim is to develop “non-electric” applications. Earlier this week at the conference, Nobel prize winning physicist Carlo Rubbia repeated an observation of his from a few years ago that China could generate the 2007 equivalent of its total electricity production – 3.2 trillion kWh, using a relatively small amount of thorium.

With those ambitious plans and with the program currently funded at around $400 million, Xu suggested that at some next stage the TMSR program will need an extra $2 billion “for the whole alternatives.”

China is collaborating with the U.S. Department of Energy on the molten salt-cooled reactor, which is the only publicly declared MSR programme in the world with funding in the hundreds of millions of dollars.

The four-day ThEC, which ended on Thursday, included a clarion call from former UN weapons inspector Hans Blix for thorium fuel as an anti-proliferation choice, and an equally loud entreaty by Rubbia who said thorium has “pre-eminence” over uranium, the conventional nuclear fuel. One big uranium devotee, nuclear giant Areva, announced a thorium collaboration with Belgian chemical company Solvay.

The conference, on the campus of international physics lab CERN, featured lively discussions of how best to deploy thorium, including driving them with particle accelerators, and using uranium isotopes to start a thorium fission reaction.